This article will introduce the two variations of the reverse triangular merger: the taxable version (commonly reversed to as the reverse triangular cash merger) and the tax-free version. We will also discuss the tax considerations that accompany these two types of mergers.

In both scenarios, the transaction would involve the creation of a new subsidiary. On the surface, it might appear that the introduction of a new entity merely creates more administrative and other burdens. However, in some situations, it is necessary for the target company to remain in existence after the acquisition, e.g., when the target holds licenses or contracts that are difficult to transfer, and the reverse triangular merger becomes an attractive way to accomplish these non-tax goals.

What is a Reverse Triangular Cash Merger

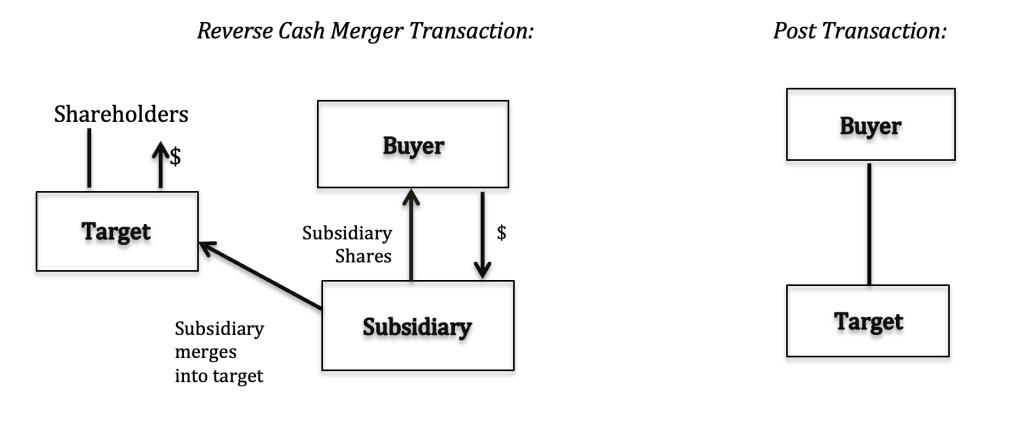

A reverse triangular cash merger occurs when:

1. An acquiring company creates a subsidiary;

2. The subsidiary merges into the target company and then liquidates;

3. The target company survives and becomes a subsidiary of the acquirer; and

4. The target company’s shareholders receive cash.

Example: Acme Corp. wants to buy a startup competitor, Stark Industries. Acme decides that the best course of action is to initiate a reverse cash subsidiary merger. Acme creates a subsidiary entity which then merges with the target entity, Stark Industries. The subsidiary ceases its existence upon the merger, leaving Stark as the surviving entity and a subsidiary of Acme. In the transaction, the shareholders of Stark will receive cash.

After Reverse Triangular Cash Merger

Generally, the reverse triangular cash merger is treated as a stock sale for tax purposes. As a result, the buyer will not receive a step-up on the basis of the assets of the target company. See further discussion in Asset Sales vs. Stock Sales.

Moreover, as mentioned earlier, the target company remains in existence after the transaction, therefore any contracts or licenses of the target company will not be disturbed.

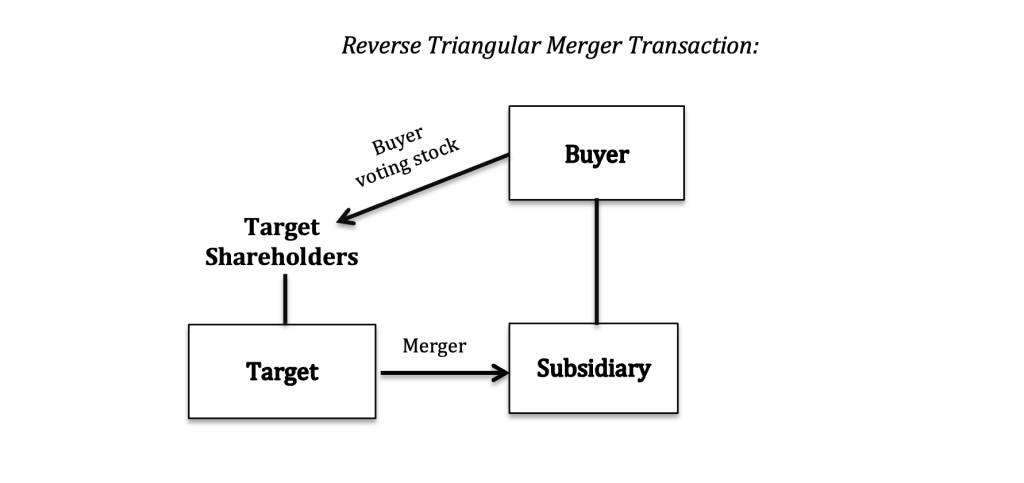

Tax-Free Reverse Triangular Merger

Depending on how the deal is executed, a reverse triangular merger can be either taxable or nontaxable. If it is taxable, then it is treated as a stock purchase as described above. On the other hand, it can also be structured as a tax-free reorganization if it qualifies under Internal Revenue Code Section 368(a)(2)(E). A myriad of complex requirements must be met, including the following:

- The acquirer must control (the subsidiary immediately prior to the merger;

- After the merger the target company must hold substantially all of its assets and substantially all of the properties of the subsidiary; and

- The target company’s shareholders must exchange stock of the target company constituting control of the target for voting stock of the acquiring company.

Very generally, “control” is defined as stock possessing 80% of the voting power of all voting stock classes and at least 80% of shares of all other classes of stock.

In addition, the transaction must satisfy the “continuity of business enterprise rule” (i.e., the entity must continue the target company’s business or use a substantial portion of the target’s business assets in its business) as well as the “continuity of interest rule” (meaning that the shareholders of the acquired company must hold an equity interest in the acquiring company).

In other words, in the tax-free version, the shareholders of the former target company receive voting stock of the acquiring company in the exchange. By contrast, the shareholders will receive cash in a taxable reverse cash merger.

Diagrams of Organizational Structure

Your tax adviser might show you a diagram similar to the one below to illustrate in a visual format how a reverse cash merger is structured. The boxes represent legal entities, and the connecting lines represent the economic relationship between each entity. The post-transaction organizational chart reflects the continued legal existence of both entities, even though the acquirer owns the target’s economic assets, liabilities, and most if not all of its stock.

Conclusion

One of the reasons to pursue reverse cash or triangular merger is the ability to maintain the target company’s legal status, which helps it preserve contracts and other nontransferable assets. Also, the transaction structure makes it easier to squeeze out minority shareholders or cash out options. As a result, the reverse triangular merger is a perennial favorite amongst publicly traded companies.