This article will discuss two different types of acquisitions: asset sale vs stock sale. Perhaps your company is in talks with another company who is looking to buy or sell. How should your company approach the sale? The answer is: it depends on your goals as a buyer or a seller. There are a number of other more complex types of mergers, such as Reverse Cash Subsidiary Mergers, but asset and stock deals are among the most straightforward acquisitions. An asset sale occurs when a business sells all or a portion of its assets. The seller, or target company, in this type of deal, is still legally the owner of the company, but no longer owns the assets sold. In a stock sale, the buyer acquires equity from the target company’s shareholders.

Asset Sale

An “asset sale” refers to the acquisition of individual assets and liabilities. The seller is required to transfer their individual net assets at their fair market values in an asset deal. The buyers receive a step-up on a tax basis to fair market value from the target company’s original investment. They benefit from the step-up on a tax basis because it allows the buyer to depreciate or amortize the acquired assets each year. The buyer also benefits because liabilities often remain the responsibility of target companies. A drawback for sellers in an asset deal is that the seller undergoes a “double tax.” The corporation pays a capital gains tax at the entity level if the assets have been appreciated, and then the individual shareholders are taxed on assets sold. A shortcoming that both sides should consider in an asset deal is that transferring assets may be difficult, and agreements concerning those transfers may need to be renegotiated.

Advantages of Asset Sale

- The buyer receives a step-up in basis of assets acquired

- The buyer usually does not have to assume the liabilities of the target company.

Disadvantages of Asset Sale

- The seller is subject to a double layer of taxation

- Transferring assets may be more complicated

- Agreements tied to certain assets may need to be renegotiated

Stock Sale

In a stock sale, the buyer acquires the equity from the target company’s shareholders. A notable benefit of stock sales over asset sales is that stock sales do not involve extra negotiation over long-term contracts with customers. Both sides benefit from the relative simplicity of a stock sale. However, a disadvantage of stock sales for buyers is the inability to step up the tax basis of acquired net assets to fair market value. Instead, the buyer receives the target company’s tax basis, and the buyer will be subject to more capital gains taxes upon any sale of stock. This happens because the legal ownership of the acquired net assets remains unchanged in the process of a stock deal. The net assets continue to be held, legally, by the target company instead of the buyer.

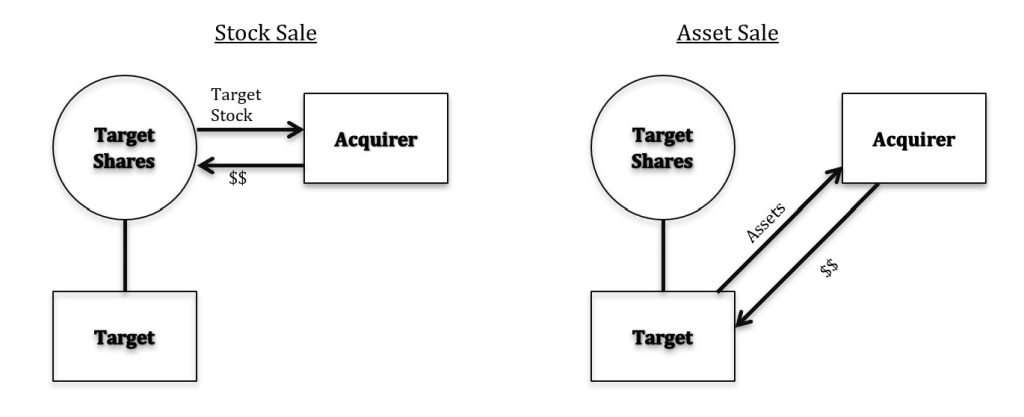

When you are discussing these types of sales with your tax adviser, you may see the following organizational charts. They are meant to visually simplify the above concepts. Note that in a stock sale, the separation of the “acquirer” rectangle and the “target” rectangle shows that the two entities remain separate for legal purposes.

Advantages of Stock Sale

- Cash goes directly to the shareholders

- Transferring stock rather than assets is a less complicated transaction

Disadvantages of Stock Sale

- No step-up in the tax basis of assets acquired, with the exception of 338 (h)(10) and 336(e) elections (read The Unicorn of M&A: 338(h)(10) Elections and S corporations to learn about these elections).

- The lower depreciation expense can result in a higher future tax for the buyer, as compared to an asset sale.

- The buyers may accept more risk by purchasing the company’s stock including all contingent risks that are unknown or undisclosed.

Diagram: Stock Sale vs Asset Sale

Conclusion

Remember that the answer to our question of how to approach the sales process is that it depends on each entity participating in the process. Keep in mind this important caveat to the disadvantages listed below: a savvy negotiator can use these disadvantages to improve another part of the deal to their favor. For example, a buyer might advocate for an asset deal in order to be eligible for a stepped-up basis in the assets they purchase, and in turn, a seller might successfully argue that capital gains paid on appreciated assets translate to a higher asking price. It is to the benefit of negotiators to have a knowledgeable tax adviser in their corner to keep them apprised of the tax consequences of different types of deals.