On Friday, September 8, 2023, the IRS and Treasury published Notice 2023-63 (the “Notice”), announcing their intention to propose regulations related to the amortization of research and experimental (“R&E”) costs. The forthcoming guidance anticipated by the Notice addresses (1) the capitalization and amortization of R&E expenditures pursuant to the Tax Cuts and Jobs Act (“TCJA”) of 2017, (2) the interaction of §174 and rules related to the tax treatment of long-term contracts, and (3) proper treatment of cost-sharing arrangements involving R&E expenditures. Such guidance would apply for taxable years ending after September 8, 2023, and would allow for taxpayers to obtain automatic consent to apply any changes in accounting method. Taxpayers may rely on the provisions of the Notice for tax years ending after December 31, 2021, provided they rely on all the rules in the Notice and apply them consistently.

Before its amendment by the TCJA, §174(a) allowed taxpayers to either currently deduct R&E expenditures or defer deductions over a period of at least 60 months. The TCJA modified §174 to require capitalization of such costs and amortization over a period of 60 months (180 months for costs related to foreign research). These new rules became effective for taxable years beginning after December 31, 2021, and are particularly disadvantageous to companies with significant R&E expenses. There appears to be some bipartisan support to revert §174(a) to prior law and allow taxpayers to currently deduct R&E expenses, but passage of any legislative fix is uncertain.

Friday’s Notice specifically addresses the following:

Application and Definitional Aspects of §174

Specified R&E Expenditures and Activities

Section 174(a) requires capitalization of specified R&E (“SRE”) expenditures. SRE expenditures are those (a) paid or incurred in connection with a taxpayer’s trade or business, and which are in the experimental or laboratory sense (generally, “SRE Activities”),[1] as well as those (b) paid or incurred in connection with the development of computer software.[2] This includes all costs incident to research and those incurred on the taxpayer’s behalf by another person.

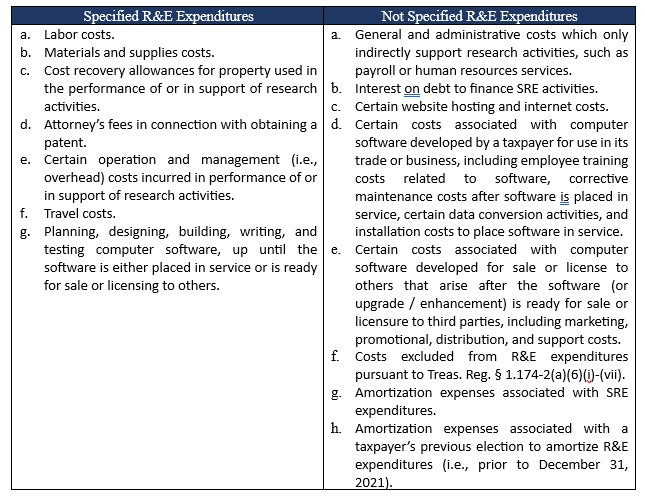

The Notice presents examples of expenditures included and excluded from the definition of SRE expenditures, namely (not exhaustive):

Friday’s Notice provides clarity related to the allocation of costs between SRE Activities and ineligible research activities. Notably, taxpayers should allocate SRE expenditures to eligible SRE activities on the basis of cause-and-effect or other reasonable relationship between the costs incurred and SRE activities. The allocation method for one type of cost may differ from another, although each type of cost must have a method which is consistently applied. For example, labor costs may be allocated based on hours worked on SRE activities and cost recovery may be allocated based on square footage supporting SRE activities. The allocation method applied to each type of cost must be applied consistently with respect to each type of cost.

Software Development

As noted above, computer software development costs are included within the scope of §174. The Notice defines software as any computer program or routine designed to cause a computer to perform desired function(s), and related documentation. This includes system, programming, application, and embedded software, either developed for use in a taxpayer’s own business or intended for license or sale. Incidental and ancillary rights of such software also fall within this definition. However, computer software does not include certain data or information bases,[3] such as customer lists or client files, unless such items are in the public domain and incidental to a computer program.

Computer software also includes upgrades and enhancements, as long as these result in additional functionality, speed, or efficiency. Although purchased computer software generally does not fall within the scope of §174, upgrades and enhancements to such purchased software do.

Once a taxpayer has identified whether a particular asset falls within the definition of computer software, he must assess whether costs incurred with respect to such software constitute software development activities. Examples of such activities can be found in the Specified R&E Expenditures section above.

Research Performed Under Contract

Under existing regulations, costs incurred by a research recipient (i.e., the party which contracts with a research provider to perform research services or develop a product) qualify for §174 treatment if such expenses would have qualified if the recipient had performed the research himself.[4]

The Notice describes the treatment of costs incurred by a research provider. If the research provider (a) bears financial risk under the terms of the contract (i.e., the research provider may suffer a financial loss related to the failure of the research to produce the pilot model / process / formula / invention / technique / patent / computer software or similar) or (b) has the right to use or exploit the developed software, then those costs fall within the scope of §174 and are required to be capitalized.

Midpoint Convention

As noted above, specified R&E expenditures require capitalization and subsequent amortization. §174 requires that such amortization begin at the midpoint of the year in which the expenses were paid or incurred. Friday’s Notice provides a more exacting definition of midpoint, namely the first day of the seventh month of the taxable year in which the SRE expenditures are paid or incurred (i.e., July 1st, for calendar-year taxpayers).

Short Tax Years

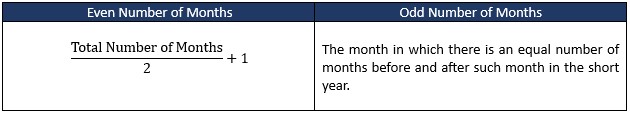

According to the Notice, the midpoint of a short tax year is the first day of the “midpoint month,” which is determined as follows, depending on whether the short tax year has an even or odd number of total months:

The Notice anticipates further guidance regarding the treatment of short tax years under §174. Specifically, the amortization deduction for a short tax year is based on the number of months in the short tax year. Should a taxpayer have two successive short tax years in which one ends in the same month another begins, the taxpayer should include that month in the first year but not the second.

Disposition, Retirement, or Abandonment of Property

The Notice also clarifies the treatment of unamortized SRE expenditures if property with respect to which such expenditures are paid or incurred is disposed of, retired, or abandoned. In general, such unamortized costs are continued to be amortized over the remaining §174 amortization period by the taxpayer which originally incurred such expenditures. In other words, no immediate recovery is allowed on account of such disposition, retirement, or abandonment. Further, such unamortized amounts do not factor into any gain or loss computation of the transferor.

Should a corporation cease to exist, the treatment of unamortized SRE expenditures hinges on whether such transaction is described in §381(a).[5] If the transaction is described in §381(a), the acquiring corporation (e.g., a parent corporation whose corporate subsidiary liquidates pursuant to §332) will continue to amortize the relevant costs over the remaining period. Should the transaction not be described in §381(a), the corporation which ceases to exist is allowed to deduct unamortized SRE expenditures in its final tax year.

Leo Berwick Insights:

The proposed changes anticipated by the Notice provide clarity for taxpayers regarding the application of §174 in the context of M&A transactions and intra-group restructurings. The new rules will impact after-tax returns of investors who engage in R&E activities, particularly those engaged in the production, enhancement, or improvement of computer software (whether as a recipient or provider of services). Guidance related to the mid-point convention, short tax years, and the tax treatment of unamortized costs upon disposition, retirement, or abandonment, may materially alter the timing of returns in investors’ cash tax models, either positively or negatively.

Notably absent from the Notice is anticipated guidance related to interaction of §174 and partnerships, specifically related to property within the scope of §174 which is transferred to or from a partnership, or which involves partnerships that undergo merger, consolidation, or liquidation. Further complicating matters, the Notice explicitly states that guidance set out in the Notice related to the disposition, abandonment, or retirement of property, as described above, cannot be relied upon with respect to partnerships. Current ambiguity related to this matter could have varied impacts on the timing of deductions for taxpayers investing in flow-through structures.

The Notice also does not address but requests comments regarding the application of §59(e) (which had previously allowed taxpayers to defer amortization deductions related to R&E expenditures over a 10-year period) to §174, which raises questions as to whether such option may once again become available, to the benefit of taxpayers engaged in foreign research.

Taxpayer comments are also requested as to whether special §174 rules should be applied for start-ups, the definition of computer software, examples of expenditures which are or are not eligible software development costs, and whether additional guidance and safe harbors are needed for identifying expenditures allocable to SRE activities, and the allocation of such expenditures to SRE activities.

Lastly, the Notice makes clear that the proposed changes are not intended to change the rules and definitions for determining eligibility for or computation of the research credit under §41 and the regulations thereunder. Similarly, the Notice requests taxpayer comments on the interaction between §174 and §280C(c)(1)(B), which requires taxpayers to reduce the §41 research credit by the “amount allowable as a deduction,” a somewhat ambiguous term in light of the capitalization and amortization rules introduced by the TCJA and discussed herein, and which has typically been interpreted to require taxpayers to reduce amounts chargeable to capital account (and subsequently amortized) as research expenses are paid or incurred and the research credit is taken with respect to such expenses.

The modeling of the new §174 amortization rules may be complicated. A Leo Berwick professional can assist with matters involving R&E expenditures to ensure proper application of the new rules.

Long-Term Contracts

Section 460 requires taxpayers to use the percentage-of-completion method (“PCM”) to account for taxable income earned from a long-term contract. A long-term contract generally encompasses building, installation, construction, and manufacturing contracts which require more than 12 calendar months to complete.

The PCM requires a taxpayer to recognize contract revenue in an amount which corresponds to the ratio of contract costs incurred over total estimated contract costs.[6] For example, if a long-term contract price is $1M, and a taxpayer incurs 30 percent of its total estimated costs associated with such contract in tax year 20X3, the taxpayer will recognize $300K of revenue in 20X3.

Current regulations specify that contract costs which determine revenue recognition under §460 include R&E expenditures incurred, other than “independent R&E expenditures.”[5] These rules were drafted when R&E expenditures could be currently deducted. The Notice describes modifications such that R&E expenditures are considered incurred for purposes of the PCM as they are amortized and deducted pursuant to §174(a)(2)(B). This will solve the mismatch between revenue recognition and expense deduction for long-term contracts involving R&E activities.

Leo Berwick Insights:

The anticipated rules described in the Notice related to the PCM will likely materially affect taxpayers who engage in long-term contracts which involve R&E activities (e.g., software developers, engineering firms, concessionaires in certain public private partnership arrangements). These new rules will generally defer revenue recognition for taxpayers, and therefore produce an overall time-discounted tax benefit.

Further clarity is needed as to whether total costs allocable to a long-term contract include all capitalized costs, or only those amortizable within the contract period. The Notice requests taxpayer comments in this regard, as the former option may result in a partial deferral of income recognition until the year following the contract’s completion.

The Notice also requests taxpayer comments on whether special rules should be developed for the application of the §460 guidance described herein to long-term contracts with the government, presumably referencing the complicated and often-debated tax treatment of public private partnerships, an area of expertise for the Leo Berwick team.

We recommend consulting Leo Berwick to ensure proper application and modeling of PCM with respect to R&E expenditures, particularly regarding whether such expenditures are “independent,” which determines whether the beneficial tax treatment described in the Notice applies.

Cost-Sharing Regulations

Subject to US transfer pricing regulations, taxpayers may share costs associated with intangible property development under a “cost-sharing agreement.” Generally, a participant in such an arrangement shares costs in proportion to the participant’s reasonably anticipated benefit from the exploitation of the developed intangible.

Under existing regulations, cost-sharing payments made between participants to reimburse R&E expenditures governed by §174 generally will be treated as an increase to R&E expenditures for the payor and a reduction for the payee.[6] Any reduction in R&E expenditures prescribed under these rules which is in excess of the amount of costs allocated to a taxpayer under a particular cost-sharing arrangement is treated as taxable consideration to the payee.

The Notice anticipates new proposed regulations which would modify existing rules to ensure cost-sharing payments are properly allocated between (a) amounts requiring capitalization under §174 and (b) amounts eligible for current deduction, in proportion to the total costs in each category.

Leo Berwick Insights:

Taxpayers engaged in transfer pricing arrangements involving R&E activities should beware of the effect that the anticipated rules will have on the timing of deductions and income associated with the payment and receipt of cost-sharing payments, respectively.

The transfer pricing rules prescribed under §482, and their interaction with the R&E rules of §174, are complex and often consequential, and we therefore recommend consulting Leo Berwick for proper application of such rules and implementation into cash tax models.

For advice on navigating the new rules anticipated by the Notice, please contact Tania Wang, Partner (tania.wang@leoberwick.com), Joe Volk, Managing Director (joe.volk@leoberwick.com), and Thomas Greco, Senior Associate (thomas.greco@leoberwick.com).

[1] §1.174-2(a)(1)

[2] §174(c)(3)

[3] By reference to those defined in §1.197-2(b)(4)

[4] §1.174-2(a)(10)

[5] Section 381(a) transactions include the tax deferred acquisition of assets of a corporation by another corporation as a result of §§ 332 and 361, but only insofar as the §361 transfer relates to a reorganization described in §368(a)(1)(A), (C), (D), (F), or (G)

[6] §1.460-4(b)(2)(i)

[7] §1.460-5(b)(2)(vi)

[8] 1.482-7(j)(3)(i)