Long awaited legislative proposals for the Clean Technology Manufacturing (”CTM”) Investment Tax Credits (“ITC”) were issued in late 2023 (the “CTM ITC Proposals”). The CTM ITC provides for a headline 30% refundable ITC for qualifying CTM expenditures. The CTM ITC Proposals should be of keen interest to:

- Manufacturers of equipment used in clean technology projects,

- Manufacturers of zero-emission vehicles,

- Parties involved in the extraction processing, and recycling of minerals used in component parts of clean technology projects and electric vehicles, and

- Investors in these sectors.

Leo Berwick has analyzed the CTM ITC Proposals and provided some insights below. If you have further questions about the CTM ITC Proposals, please contact Steven Hurowitz, Partner (steven.hurowitz@leoberwick.com) and Zack Bhatia, Director (zack.bhatia@leoberwick.com).

Background

The CTM ITC was first introduced in the 2023 Canadian Federal Budget (“Budget 2023”). Budget 2023 documents explained the reasoning for introducing the CTM ITC being:

- The Buy North American provisions for critical minerals and electric vehicles in the U.S. Inflation Reduction Act will create opportunities in Canada; and

- U.S. acceleration of clean technology manufacturing will require robust supply chains of critical minerals that Canada has in abundance.

To take advantage of the above noted opportunities, the CTM ITC is intended to incentivize private investment in new machinery and equipment used to manufacture or process key clean technologies, and extract, process, or recycle key critical minerals, including:

- Extraction, processing, or recycling of critical minerals essential for clean technology supply chains, specifically: lithium, cobalt, nickel, copper, rare earth elements, and graphite;

- Manufacturing of renewable or nuclear energy equipment;

- Processing or recycling of nuclear fuels and heavy water;

- Manufacturing of grid-scale electrical energy storage equipment;

- Manufacturing of zero-emission vehicles; and,

- Manufacturing or processing of certain upstream components and materials for the above activities, such as cathode materials and batteries used in electric vehicles (“EVs”).

Leo Berwick Insights: The December Proposals mirror the legislative framework for the Clean Technology ITC (“Clean Tech ITC”). Accordingly, the potential issues and opportunities highlighted in our articles Canadian Clean Technology Investment Tax Credit and Initial Views: Canadian Clean Technology Investment Tax Credit generally apply to the CTM ITC.The only major differences in the CTM ITC legislation are:

- The nature and type of property that qualifies for the CTM ITC;

- There are no labour requirements to qualify for the maximum CTM ITC; and

- The timing of the availability and phase out of the 30% headline ITC rate (discussed further below).

CTM ITC Rate

The headline CMT ITC rate is 30% of the capital cost of CTM property, i.e. same as the headline ITC rate for the Clean Technology ITC. There are a few differences in the timeline for the implementation and phase out of the ITC rates.

Notes

1 Period in which the project expenditure becomes available for use

2 Subject to unpaid amount rule. If expenditure unpaid on the day that is 180 days after the end of the taxation year in which a deduction in respect of a CTM ITC would otherwise be available in respect of the property, such amount is to be deferred until year in which paid

3 Clean Teach ITC rates assume that claimant elects to meet prevailing wage requirements and the apprenticeship requirements; if no election rates are reduced by 10 percentage points

4 Rates also assume that all other eligibility criteria are met

CTM Property

The CTIM ITC is computed by multiplying the specified percentage (i.e., the applicable CTM ITC rate) by the capital cost of CTM property. The term “CTM property” refers to property that is acquired by a taxpayer in a year for a CTM use provided certain additional requirements are met. “CTM use” refers to property used in:

- Certain qualified zero-emission technology manufacturing activities; or

- A qualifying mineral activity producing all or substantially all qualifying materials.

The additional requirements include the CTM property must:

- Be situated in Canada;

- Be intended for use exclusively in Canada;

- Not have been used or acquired for use for any purpose before it was acquired by the taxpayer;

- Fall within certain undepreciated capital cost allowance (“UCC”) classes that pertain to an eligible CTM use; and

- Not be excluded property.

Qualified Zero-Emission Technology Manufacturing Activities

In 2021 the Canadian Government introduced a tax credit for zero-emission technology manufacturers. The tax credit effectively reduced the federal corporate tax rate on profits of zero-emission technology manufacturers to 7.5% (4.5% for small businesses) The CTM Proposals leverage the existing regulations for this tax credit. Under these regulations certain “qualifying activities” that are performed in connection with the manufacturing and processing (“M&P”) of the following property may qualify as “qualified zero-emission technology manufacturing activities”:

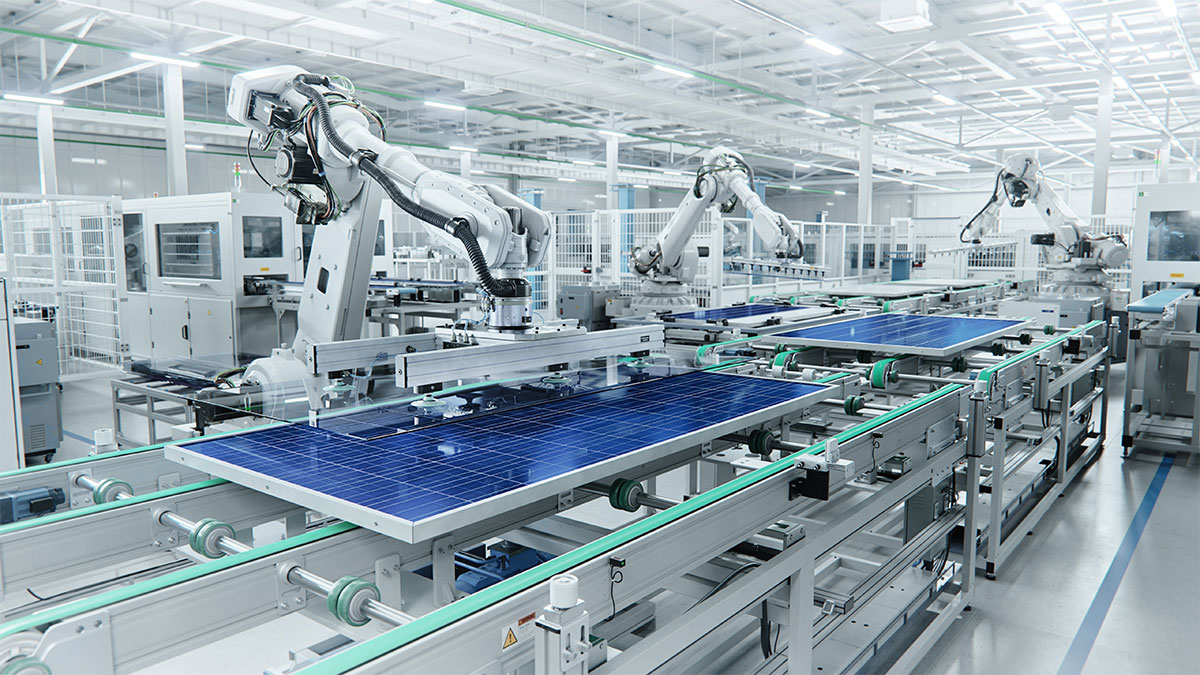

- Solar energy conversion equipment, including solar thermal collectors, photovoltaic solar arrays and custom supporting structures or frames, but excluding passive solar heating equipment;

- Wind energy conversion equipment, including wind turbine towers, nacelles and rotor blades;

- Water energy conversion equipment, including hydroelectric, water current, tidal and wave energy conversion equipment;

- Geothermal energy equipment;

- Equipment for a ground source heat pump system;

- Air-source heat pump equipment designed for space or water heating;

- Electrical energy storage equipment used for storage of renewable energy or for providing grid-scale storage or other ancillary services, including battery, compressed air and flywheel storage systems;

- Equipment used to charge, or to dispense hydrogen to, property included in K.,

- Equipment used for the production of hydrogen by electrolysis of water;

- Equipment that is a component of property included in clauses (A) to (H), if such equipment is purpose-built or designed exclusively to form an integral part of that property;

- Certain “zero-emission vehicles”, fully electric or hydrogen powered automotive equipment and additions or alterations to automotive equipment causing them to be fully electric or hydrogen powered and integral components of the powertrain of such vehicles including batteries or fuel cells and equipment used to charge, or to dispense hydrogen to, such property; and

- Under proposed amendments certain nuclear equipment, heavy water, fuels and fuel rods.

Excluded are activities in respect of the M&P of general purpose components or equipment which components or equipment are suitable for integration into property other than property described above.

Qualifying Activities

For purposes of the CTM ITC, the existing rules for determining eligible M&P activities for purposes of the existing M&P tax credit are used. These rules specify the types of activities that qualify as M&P (e.g., receiving and storing of raw materials) and the types of activities that do not qualify (e.g., storing, shipping, selling and leasing of finished goods).

Qualifying Mineral Activity and Qualifying Materials

In essence, qualifying mineral activity includes certain extraction processing, recycling and synthetic graphite activity and spheronization of graphite or coating of spheronized graphite producing:

- Lithium;

- Cobalt;

- Nickel;

- Copper;

- Rare earth elements; and

- Graphite.

UCC classes

As noted above, one of the criteria is that expenditures must fit with certain eligible UCC classes. The following generally describes the type of property that falls within the eligible classes:

- Machinery and equipment used for M&P, such as industrial robots used to manufacture electric vehicles or vats used to process cathode active materials.

- Certain tangible property attached to buildings and other structures used for M&P or that is required for machinery or equipment, such as ventilation systems used to remove chemical fumes or specialized electrical wiring used to provide power to solar panel manufacturing equipment.

- Certain property used for mineral extraction and processing, such as equipment used to crush rock containing copper ore or kilns used to calcinate nickel ore.

- Certain specialized tooling, such as moulds used to cast copper ingots at smelters or cutting parts of a machine used to cut solar cells.

- Non-road vehicles and automotive equipment, such as electric vehicles designed for use in factories or hydrogen-powered vehicles designed for extracting rock from mine sites.

Excluded Property – No “Double Dipping” Rule

To encourage the production in Canada of batteries for EVs, the Canadian Government has agreed to make contributions to certain EV battery manufacturers. The CTM ITC cannot be claimed for the cost of property used in production that has benefited from such Canadian Government contributions.

Consultation Period

The Canadian Department of Finance (“Finance Canada”) has launched a consultation period for the CTM ITC Proposals. If Finance Canada follows a timeline similar to the Clean Tech ITC legislation, then draft legislation can be expected in spring 2024.

Conclusion

Overall, the proposed CTM ITC can provide significant incentives for manufacturing, extraction, and processing activities in the clean energy sector. Leo Berwick can assist with:

- Tax structuring to maximize the available CTM ITC

- Tax modeling to project the potential cash tax benefits and other tax impacts of the CTM ITC

- Reviewing CTM ITC eligibility based on capital costs, and

- Assisting investors through the process of insuring key tax risks associated with the CTM ITC

If you have further questions about the CTM ITC, please contact Steven Hurowitz, Partner (steven.hurowitz@leoberwick.com) and Zack Bhatia, Director (zack.bhatia@leoberwick.com).